Shareholder's Meetings of the New Hermand Oil Co. Ltd.

type: Companies - shareholders' meetings

1899

NEW HERMAND OIL COMPANY .

An extraordinary general meeting of the New Hermand Oil Company was held yesterday afternoon in Lyon & Turnbull’s Room, George Street, Edinburgh, for the purposes of making certain alterations to the articles of association so as to bring them into conformity with the requirements of the Stock Exchange. In the circular calling the meeting it was intimated by the directors that they had deemed it advisable to call up the 1s. 8d. per share on the shares now only partly paid.

In explaining the object of the meeting, Mr E Chalmers, chairman of directors, who presided, stated that their articles of association were practically those of the old Company, but that it seemed that they did not pass muster with the Stock Exchange nowadays. The changes now proposed were distinctly in favour of the shareholders.

A resolution giving effect to the proposed alterations was proposed by the Chairman, seconded by Mr D. Stewart, and unanimously adopted. Afterwards, making a statement in regard to the position and prospects of the company, the Chairman mentioned that the full number of 120 retorts had been in operation for a few weeks, and that whilst up to the present they were not doing just all that the directors might wish, he looked forward very soon to their doing all that was anticipated. They had practically gone in for a new sulphate of ammonia.

They were busy putting in plant for the recovery of naphtha, and they expected a yield of two gallons per ton of shale, giving them some 360 gallons of naphtha per day. Just now they were making between 4000 and 5000 gallons of oil daily. Their oil was all sold. Two or three months ago the Company made a contract for their entire production of oil for a twelvemonth. Although he had been told they were too soon in fixing their contracts, he had not yet come across anybody who would pay the Company more than they were getting. In conclusion, he said he looked forward with hope and confidence to a fairly successful career for the Company, provided they had no startling or untoward events in the oil world; and so far as he could gather from conversations with people long connected with the trade, there was a general feeling that they were in for at least a few years of very considerably better times than the oil trade in Scotland had experienced for a long time past. They had still on their own property, apart from what they leased., something over three million tons of shale.test

The Scotsman, 27th October 1899

.......

1900

THE NEW HERMAND OIL COMPANY

The report by the directors of this Company with respect to the Company’s affairs as at 31st March last (a brief summary of which appears in our commercial news) is as follows : —

The accounts cover the period the taking over on 10 March 1899 of the undertakings of the Old Hermand Oil Company (Limited), but the works have not been in full operation since that date. Some time necessarily elapsed before the various departments were got into working order. A partial start was made with 40 retorts on 7th July, but it was three months later before the full 120 retorts were in operation. Since then various difficulties, resulting mainly from the works having stood idle for nearly eight years, have been met. Matters are now working smoothly. The directors regret that the accounts are not of a more favourable nature but it is to be remembered that the Company has been working at a considerable disadvantage in consequence of the antiquated nature and worn out condition of the retorts. The anticipated yields of oil and ammonia have not been realised. This is doubtless partly owing both to the condition of the retorts, and to the fact that a proportion of the shale put through had been lying exposed to the weather for some years. With reference to the balance at debit of profit and loss account (£1763, 6s, 7d.) , it may be stated that this includes a sum of £463, 10s. 3d,., which the directors are of the opinion might form a proper charge against capital, but it has been thought better to charge same against revenue. A trading account was opened on 7th July, and all the “oncost” charges were thereafter debited against it, though it will be observed that only one-third of the retorts were going for three months after that date.

The directors are giving attention to the Company’s shale fields. They were originally led to rely upon No. 4 pit, West Breich, for their supply of shale, but found this insufficient to keep the retorts fully charged. A new mine, which gives every promise of yielding a large and regular supply, has been opened on the Company’s own property of Mid Breich, and another mine on West Breich estate will shortly be opened. From these mines a large supply of shale of good quality will be available. Two tests of the Company’s shale in bulk, one from Mid Breich and the other from West Breich, have recently been made through modern retorts, and the results have been of a decidedly satisfactory nature, the yields being very considerably better than are at present being obtained through the Company’s own retorts. Since the advance in the price of coal the Company have worked the coal fields leased by them and obtained supplies at a cost very considerably under what would have had to be paid in the open market.

With reference to the position of matters at Walkinshaw, most of the shareholders are doubtless aware that the old Company carried on there two fairly large farms. The directors of the Company shortly after reconstruction, made overtures for the renunciation of the leases of these two farms. These overtures resulted successfully. The old Company also held a lease of the old refinery and brick work at Walkinshaw. The brick work has been sub-let at a satisfactory rental, and some little time ago the directors disposed of all the old plant in the refinery, taking advantage of the high prices ruling recently for such material. The plant was sold partly by private bargain and partly by public auction, and the directors were thoroughly pleased with the price realised. The annual liabilities at Walkinshaw are now reduced to something less than £200, and the proprietor has recently indicated that he will relieve the Company of the lease (which has still about 3½ years to run) if a satisfactory tenant for at least a considerable portion of the ground is found.

Prospects for the future are decidedly encouraging. According to mining engineers’ reports there is an abundance of shale sufficient to last many years. Coal – one of the heavy items of oncost – is being obtained at a reasonable cost in sufficient quantity to supply the wants of the Company. The market for products is good and prices seem likely to be maintained. The only drawback is that the retorts are old and worn out.

The directors have given much consideration to the question of new retorts, and have now no hesitation in recommending the Company to sanction their erection. With the view of providing the necessary capital, they propose that the capital of the Company should be increased by £30,000 in 7 per Cent Preference shares. Of this amount they consider that £25,000 should be offered forthwith for subscription. They are advised that this sum will provide ample funds for the erection of 64 retorts of an improved type, with all the necessary connections and plant capable of a daily throughput of 240 tons. At present there are 120 retorts in use, capable of a daily throughput of only 180 tons.

A large saving can be effected both in consumpt of coal and expense of working the new retorts as compared with the old ones, and the directors are quite satisfied that provided prices remain at anything near present values, a very respectable dividend can be earned on the Ordinary shares, after paying the Preference dividend. It will be observed that the advantages are twofold:- 1. A large saving in working costs. 2. Considerably increased yields of both oil and ammonia. These advantages together may be moderately estimated in figures at 2s. per ton, which on 240 tons of shale per day, is equal to an annual sum of between £3000 and £5,000.

The directors, the report adds, entertain no doubt that the proposed issue of preference shares will be readily subscribed.

The Scotsman, 14th July 1900

.......

1900

THE NEW HERMAND OIL COMPANY.

The first annual general meeting of the New Hermand Oil Company (Limited) was held in Lyon & Turnbull's Rooms, Edinburgh, yesterday - Ebenezer Chalmers, the chairman of the company, presiding. There was an attendance of about 30 or 40 shareholders.

The Chairman said with reference to the past proceedings of the directors, during the past year they had had a number of difficulties to surmount, but he thought they had gradually overcome them and that they were now in fairly smooth waters. It would be pretty well understood that when the works of any company had stood idle for about eight years it could not be started right away without hitches here and there.

They would observe that the anticipated yields of the oil and shale had not been realised. That was partly owing to the condition of the a retorts, partly owing to the fact that a considerable portion of shale was shale that had been exposed to the weather for six or eight years, and partly because they had a difficulty in keeping the retorts fully charged. - They were led to rely upon No. 4 Pit for a full supply of shale. They were disappointed, and within the past few months they had made it their endeavour to make sure of new supplies of shale. They were now pretty well off in that respect, and within the next week they would be opening up a new mine at West Breich, in addition to one on Mid Breich, on their own property; and he looked forward with every hope that within a very few weeks they would be on perfectly safe lines so far as supply of shale went.

The result of the past year's working showed a debit balance of £1763. That included £463 which could be directly traced to the fact that for three months they had only 40 retorts going in the place. They had been led to expect a yield of 240 tons of shale a day but their average was something under 200. The fact was that they were working with antiquated plant, with retorts that were old in point of type and also in construction. It was something like 15 years since they were built. When the company started they were quite aware that expenses were going to be greater than was calculated. Fuel had gone up, and workmen's wages.

They therefore considered it their duty when making a contract to get such a price as would recoup them for the extra expenditure. He could show that they not only got sufficient to recoup them, but something more. Had they got the anticipated yields upon which Mr Beveridge (who had reported on the works) based his calculations, with the extra price they got for the oil and the additional price for sulphate of ammonia, they would have exceeded the increased expenditure by £500 or £600.

They had now available at their mines 8,000,000 tons of shale, so that they need have no fear of running short for a long time to come. The proposition had been made that the capital of the company be increased. That would come up later, but if they got the money he would be no party to flogging a dead horse; and if it was suggested that they should do the best they could with the old retorts he would simply say that he would not be a party to that proposal. He did not think it would be worth their while to spend another penny on the present retorts, and if they were not prepared to get up-to-date plant they had better go into liquidation at once, because they not only had a chance with new retorts of getting a very considerably increased yield, more particularly of ammonia, but they had also the surety that they would be able to get that yield at a very much smaller expense than with the old retorts.

The Chairman then moved the adoption of the report. Replying to a number of questions put by Mr Stewart, the Chairman said at the present moment they were not earning any profit; but in the course of a fortnight he calculated they would be earning a profit of something like 6d. per ton, as a new contract came into force at a the beginning of next month at a considerable advance on the old contract. Mr Beveridge, who had reported on the works, was, he understood, general manager of the Linlithgow Oil Company. Mr Fraser, manager of Pumpherston Oil Works, who was asked to speak, said he had no hesitation in saying that if that company was prepared to spend a sufficient sum of money to replace the plant and put the works upon the most modern lines the company would succeed; but to attempt to work retorts that were 16 years old was simply folly. They had the shale, and they must spend money and put the works on modern lines. Unless they were prepared to do that, his advice would be not to spend a penny on the old retorts.

The report was adopted, and Mr William Lyon re-elected a director.

Mr Fraser was nominated and seconded as a member of the board, but declined the office, remarking, however, that he would do all he could for the company.

At an extraordinary meeting held afterwards it was agreed to increase the capital of the company by the creation of 30,000 Preference shares, of which 25,000 are to be forthwith offered for subscription.

Glasgow Herald, 24th July 1900

.......

1902

THE NEW HERMAND OIL COMPANY

In their annual report the directors regret that the results of the year's working have not been more satisfactory, but the works have been carried on under somewhat exceptional circumstances.

Costs have been abnormally high, and for the last four months of the financial year the building of the new retorts was in progress. It was considered advisable to build these in close proximity to the old ones, and this necessitated certain changes in the steam and other pipe connections of the latter, which interfered for a time with the usual yields. It has also to be kept in mind that the company derived no benefit from the new retorts for any part of the year under review, as they were not heated up until early in April, 1901.

It was shortly after the last annual meeting that the directors were authorised to issue 25,000 7 per cent. preference shares for the purpose of erecting new retorts. The amount applied for was £18,154, and as soon as this sum was assured the directors proceeded with the work, but owing to the full amount not being subscribed they had to curtail the number of retorts they originally intended to erect.

The yield of oil has been practically the same from the new as from the old retorts, but there has been a very fair increase in the yield of ammonia. A few months ago, when the estate of Wester Breich, from which the company derives its present supply of shale, was advertised for sale, the director were satisfied that it would be advantageous for the company to purchase, provided the necessary additional capital could be obtained.

As the result of their efforts in that direction it was arranged that a syndicate composed of shareholders of this company should acquire the property, it being first agreed that the syndicate should give two distinct advantages to the company, namely- (1) The right to purchase at an agreed price within a specified time; (2) a modification of a somewhat onerous condition in the lease with reference to payment of lordship on unworked shale. In addition to these advantages the company now enjoy further benefits which only an interested and friendly landlord could be expected to afford.

An adverse and unexpected change recently took place in the condition of the mineral oil trade of Scotland, owing in a large measure to the reduction in value of oil products originated by foreign producers. As this reduction in values necessitated cheaper working costs, the directors intimated a reduction in wages, which they were sorry to say resulted in a strike of about 10 weeks' duration. The settlement ultimately was based on a fairly satisfactory compromise. Working costs are now much lower, whilst fuel and stores are being procured on easier terms, and the directors are hopeful as to the future.

West Lothian Courier, 3rd January 1902

The New Hermand Oil Company (Limited).— The second annual general meeting of shareholders was held within Lyon and Turnbull's Rooms on Monday afternoon. The chairman (Mr E. Chalmers) submitted the directors report and balsam-sheet for the year to 31st March last, and in doing so explained the delay in holding the meeting, and referred to the miners' strike which took place in July, and also to the very heavy fall that had taken place in the value of oil, which meant a difference of £9000 to £10,000 per annum. He stated that they were now getting an ample supply of shale at a moderate cost. He also expressed his regret that the shareholders had not subscribed for the full amount of preference shares, only about £18,000 having been subscribed out of £25,000 offered. This necessitated a curtailment of the original programme. He concluded by moving the adoption of the report and accounts, and after some discussion, during which a number of questions were asked and replied to by the chairman, the motion was put to the meeting, and unanimously agreed to. The meeting concluded with vote of thanks to the chairman, moved by Mr John Wilson, who strongly recommended the shareholders to subscribe the balance of the preference issue, and enable the company to put up the full bench of retorts.

West Lothian Courier, 3rd January 1902

.......

THE NEW HERMAND OIL COMPANY. Ltd.

The following is a copy of the report by the Committee, appointed by the shareholders on 23rd April, 1902, to the extraordinary general meeting of the Company to be held within Messrs Lyon and Turnbull's Rooms, No. 51 George Street, Edinburgh, on Wednesday, the 21st day of May, 1902, at three o’clock afternoon:-

At the meeting of shareholders held in Messrs Lyon and Turnbull’s Rooms on Wednesday 23rd ulto., the Chairman (Mr Chalmers) made a detailed statement with regard to the affairs of the Company, explaining what had transpired since the last meeting of shareholders, the present position of the Company, and the directors' views with regard to future prospects, and he pointed out that the circumstances now required the shareholders to consider whether the Company should go into liquidation or be reconstructed.

He advised reconstruction, and stated the reasons which led him to recommend this course, but suggested that it might be more satisfactory to the shareholders generally if they were to appoint a Committee of their own number to meet the directors to receive fuller and more detailed information and to consult with them and advise as to whether the suggested reconstruction should proceed.

We, the undersigned, were at the meeting referred to, appointed a Committee, with powers, in the event of our being favourable to the scheme proposed, to adjust the same with the Directors with a view to its being brought formally before the Company. The scheme indicated by Mr Chalmers was to reconstruct the Company under the same name with the same amount of nominal capital, viz., 30,000 preference shares of £1 each, and 70,000 ordinary shares of £1 each, and to give each preference shareholder, in exchange for every preference share held by him in the present Company, one and one-third preference shares in the new Company of the same nominal value as the present shares, viz., £1, but with 15s paid up thereon, leaving 5s of call liability—these shares bearing a cumulative preferential dividend of 6 per cent. instead of 7 per cent. as in the present Company—and to each ordinary shareholders in the present Company one ordinary share in the new Company, credited with 15s paid up thereon, in exchange for every ordinary share held by him in the present Company, thus leaving the ordinary shareholders liable for 5s on each of their new shares.

For the purpose of fixing the number of shares in the new Company to which each preference shareholder will be entitled, and at the same time avoiding fractions of shares, it was proposed to take in each case the nearest whole number not exceeding the number of shares held in the present Company with the addition of one-third thereof. The sum of 5s unpaid on each class of shares, it was suggested, should be paid in sums of one shilling on application and one shilling at the end of every three months thereafter - shareholders paying calls in advance being allowed interest at five per cent. thereon till due. The number of preference shares issued in the present Company is 18,154, and in the new Company the total issue in exchange for these will amount to a number not exceeding 24,205, being one third more. The result will be, as regards the present preference shareholders, that they will hold in the new Company shares of a nominal value equal to the total amount paid on their present shares plus the call of 5s to be paid on the shares in the new Company issued to them, but instead of the 7 per rent. cumulative preferential dividend, they will be entitled to receive 6 per cent.— , the object being, while giving the preference shareholders shares for all the money, old and new, contributed by them, to keep down the annual charge by way of preference dividend to a figure somewhat nearly approaching the amount in the present Company.

Since our appointment we have had several meetings with the directors, and have also visited the works and mines at Breich, and met there the directors and general manager, from all whom we have received fuller and more detailed information than was possible to be given in the course of a general meeting. Since visiting the works we have also met privately and considered in the light of our fuller knowledge of the circumstances, the suggested reconstruction, and we now beg to report that, as the result of our inquiry, and investigation, we are unanimously agreed in recommending to the shareholders the scheme above explained as being, in the circumstances, the best course that the Company can pursue in the interests alike of the preference and ordinary shareholders. In our opinion the assessment of both classes of shares in the sums proposed is a fair and equitable arrangement, and we have not been able to suggest any alternative schemes or any modification upon that proposed.

The principal factors inducing us to form the opinion above expressed have been the increased and steady yields of oil from the new retorts as at present working, the large amount of available shale of superior quality, the tendency of the same to improve et depth, and the demonstration to us of the reduction in working costa to be brought about by an increased throughput, all likely to result, as we are assured and believe, in the business of the Company becoming, even at the low price of oil, a remunerative one. The shale owned and leased by the Company we consider to be a very valuable asset, likely in the future to appreciate, both because its present high quality shows improvement at depth, and because other known available fields of this mineral are constantly diminishing. We also give great weight to the saving which it is evident must result in standing and oncost charges from the increased output which the erection of additional retorts of the most modern and approved description will effect. We take this opportunity of expressing our thanks to the directors for their courtesy throughout our communications with them, and our appreciation of their unsparing services in managing the Company's affairs.

Robert Hamilton (chairman) J. E. Brock, Dav. Cairns, J. Cochrane, Wm. T. Wood.

West Lothian Courier - Friday 23 May 1902

The New Hermand Oil Coy.

An extraordinary general meeting of the New Hermand Oil Company Ltd was held on Wednesday afternoon an Lyon and Turnbulls Rooms, George Street, Edinburgh—Mr E. Chalmers, Bonnington, presiding. The meeting was called for the purpose of considering, and, if approved, of passing the following two special resolutions:-.

“1. The rights and privileges of the holders of the Preference shares shall be and are hereby modified in the manner following, that is to say – If the assets and business of the company shall be sold or transferred to any new company, with a capital of one hundred thousand shares of £1 each, divided into thirty thousand Preference shares of £1 each, carrying a cumulative preferential dividend of 6 per cent. per annum and preferable also as to capital, and seventy thousand Ordinary shares, all or some part whereof shall not be fully paid, each of the holders the Preference shares held by him in this company one and one-third of equal value, viz.: £1 per share in the new company credited with 15s, paid and with a call liability of 5s per share, but, in calculating the number of shares in the new company to which any Preference shareholder shall be entitled, the same shall be taken as the nearest whole number not exceeding his holding in this company with the addition of one-third thereto."

“2. In the event of the assets and business of this Company being sold or transferred as above-mentioned, the holders of Preference shares in this Company shall not be entitled to receive payment of any arrears of dividend due to them, and any provisions, inconsistent with this or the foregoing resolution, contained in the Articles of Association of this company, and particularly in the provisions introduced into the same by special resolutions passed 23rd July. 1900, and 10th August, 1900, shall not receive effect."

In moving the adoption of the resolutions, the Chairman said he had explained at a previous meeting their position. If the Company was to live, its salvation lay with them. They had great faith in the future, and by the erection of additional retorts at the works, and much improved plant, they would succeed in bringing the cost of oil to a penny per gallon under what they could produce at present. That was the position which they desired to attain. The amount of money wanted was £19,000. They based their expectations of profitable results on the greatly improved results now got from the shale, on the large supply of shale that they had, and the considerable saving that might be expected by the increased output from the new retorts.

Mr Cochrane (Leith) seconded the adoption. The only hope of the company, he said, was by these resolutions taking effect.

Mr Harley (Dunfermline) said he was in the unfortunate position of being one of the old shareholders. Year after year they received fair promises, but the results were exceedingly disappointing. If they were to judge by the promises that day by past experience, they would be very sceptical of the future. (Hear. hear.) He had always had good hopes of this company, and these were based on the good quality of the shale. The proposals before them seemed very crude and brutal one. (laughter.) He moved an amendment that they wait the auditor had completed his report, and then further consider the proposals of the directors.

Mr Wishart seconded.

The Chairman, in answer to queries, said that, there had been a loss on the year’s working of £3000, including the loss caused by the strike in the autumn. Considerable discussion followed, and on the proposition being made, Mr Harley agreed to withdraw his amendment on the understanding that the report be issued to the shareholders a week before the meeting at which the resolutions would come up for confirmation.

The meeting then agreed to the resolutions, as also to the proposals to voluntary wind up the company with a view to its reconstruction.

West Lothian Courier - Friday 23 May 1902

.......

The New Hermand Oil Company, Limited.

An extraordinary general meeting of the New Hermand Oil Company (Limited) was held on Friday afternoon in Lyon and Turnbull’s Rooms, George Street, Edinburgh—Mr E. Chalmers, Bonnington, chairman of the directors, presiding.

The meeting was called for the purpose of confirming the following two special resolutions: -

“1. The rights and privileges of the holders of the Preference shares shall be and are hereby modified in the manner following, that is to say —lf the assets and business of the company shall be sold or transferred to any new company with a capital of one hundred thousand shares of £1 each divided into thirty thousand Preference shares of £1 each, carrying a cumulative preferential dividend of 6 per cent. per annum, and preferable also as to capital, and seventy thousand Ordinary shares of each, in consideration of the issue of shares, all or some part whereof shall not be fully paid, each of the holders of the Preference share held by him in this Company shall be emitted to receive for every Preference share held by him in this company one and one third shares of equal nominal value, viz. —£1 per share in the new company credited with 15s paid and with a call liability of 5s per share; but is calculating the number of shares in the new company to which any Preference shareholder shall be entitled, the same shall be taken as the nearest whole number not exceeding his holding in this company with the addition of one-third thereto."

“2. In the event, of the assets and business of this company being sold or transferred as above-mentioned, the holders of Preference shares in this company shall not be entitled to receive payment of any arrears of dividend due to them, and any provisions, inconsistent with this or the foregoing resolution, contained in the articles of association of this company, and particularly in the provision introduced into the same by special resolutions passed 23rd July 1900, and confirmed 10 August, shall not receive effect."

The Chairman, in formally moving the confirmation of the resolution, explained that since last meeting on the 21st May a conference had been held between the larger shareholders and the directors, and the report and balance sheet had been issued. The total expenditure involved in reconstruction was £796 2s 9d. The debit balance for the year was undoubtedly a heavy one. The entire loss incurred during the strike, however, was included in that amount. Some might be inclined to ask why they should go on working at a loss.

The loss now was much less than when they were working all the retorts. At present they were working with the new retorts alone, and an arrangement with their miners had enabled them to get a considerably improved quality of shale. The improvement in the value of the shale per ton now was about 2s 6d per ton. He attributed that partly to improved shale and partly to the fact that they were now getting a better yield of ammonia from the new retorts. In consequence of that very great improvement in the value of their products they considered they were justified in going on until now.

It was now for the shareholders to confirm the resolutions: or liquidation and winding up must take place. They were retorting about 100 tons a day, and their idea was to retort a minimum quantity of 250 tons per day.

Mr John Cochrane, Leith, in seconding, said the more he considered the situation the more he was contented that any other course than that proposed would be a most unfortunate one. There was no doubt that the Scottish oil companies at present were going through very trying times, but things were looking more hopeful, and he thought the only course open to them was to give the New Hermand Oil Company another chance. (Applause)

Mr Hew Stewart, Musselburgh, said that before the resolutions were confirmed the meeting ought to take into consideration the present Board of Directors. They had a good enough shale field, if it were properly conducted. He moved that a thorough re-arrangement be come to, that a general manager be appointed as commercial and working manager, so that the whole thing could be taken up by one man, who alone would be responsible for the general management of the company.

Councillor Harley, Dunfermline, said that before any reconstruction would be satisfactory there must be some change amongst the directors. The sheet anchor of any company of that sort was, first of all, they must have a good subject to work. He was fairly satisfied that the shale they had to work was of an excellent kind. No manager, whatever his experience, could make the company a success with the old retorts or with the small number of new retorts, and to that extent he freed the manager from responsibility. He had no reason to doubt he had done his best. They had good shale, but they had been throwing it away with the old retorts, which should have been stopped long ago.

It was necessary that there should be some change in the Board of Directors, and it was necessary also that there should be sufficient money to carry on the company. To go on working with 100 tons of shale per day was simply throwing away money. It was not perhaps so deadly as when they were using the whole of the old retorts. The results of the new retorts taken by themselves were eminently satisfactory, but the number of these new retorts was not sufficient to carry the works on at a profit. Unless there was a hearty response to the appeal for more money to build those new there was no chance whatever for the company.

The Chairman said it was incompetent to deal with the directorate at that meeting, but he might tell them that the Board were not so much enamoured of the duty of conducting the affairs of the company as to desire to remain attached to it permanently, and at the statutory meeting, which would be held within a very short period, the shareholders would have the opportunity of putting forward any gentlemen they might desire as directors.

From the balance-sheet it would be seen that they were due the bankers £2963. Every director was an obligant at the present moment for that money, and not only for that money but for other sums, and he thought that ought to be kept in mind. He could assure them that several members of the Board were desirous of retiring, and it would be an opportunity for the shareholders to come forward with practical men.

With regard to the old retorts he regretted that he had been persuaded to agree their being continued so long in use, for to the old retorts he attributed a great deal of the loss they had sustained. He did not say that with favourable markets they could not have made a profit. With regard to Mr Stewart’s motion he pointed out that t was incompetent at that meeting. Their only course was either to vote in favour of the confirmation of the resolutions or against it.

Mr John Robertson, Edinburgh, asked if the cost of the new retorts and the new plant was to come to £19,000. He made it out in that case that the present debts of the company would be nearly £33,000, and in view of that, it behoved that meeting to consider very carefully whether the resolution should be confirmed.

The Chairman said the amount that they were aiming at in the reconstruction was £19,500. It was not proposed to spend all that on new retorts, because it was not practical to do so. They would see that the debts amounted to £9700, and that had got to be provided for. That was where part of the sum of £19,500 was to go. The sum of £10,000 at least would be spent on new retorts, and they were satisfied that with such a sum they could put up sufficient retorts to put through a quantity of at least 250 tons of shale per day.

Mr J, H, Robertson, stockbroker, Edinburgh, said he did not think it was the slightest use launching animadversions on the directors for anything they had done or had not done. The present chairman had done his very best (hear, hear) – in the very worst of times, and he thought the manager had also done his best. They had not had the tools to work with; they had not had sufficient retorts; they had not had sufficient money; and they had the worst of markets. They had the future to look to, and they ought surely to benefit by the mistakes of the past. In the first place, they should replace or have a pledge for replacing the present directors by another Board, who, some thought, might do better. He did not think they could do better. They had an opportunity of making arrangements for the future, and he suggested that if they could not get a real expert on the Board of the company who was not already interested in it, they should try if they could not induce their manager, who was leaving to fill another important post, to go on the Board of the company, and give it the benefit of his advice. The manager knew the thing from top to bottom, and with their present chairman along with him, and perhaps one or two more directors at the most of the same class. He thought the company would have a fair chance.

It was essential that they must have the money to work with, and he thought they should get a pledge from the directors that without that money in their hands, they would not proceed further with the reconstruction. On a vote, 27 voted for the confirmation of the resolutions and 8 against. The resolutions were declared passed and confirmed.

The Chairman thereafter formally moved confirmation of the following resolution: -

That this company be wound up voluntarily with a view to its reconstruction, and that John Oliver, 114 George Street, Edinburgh, be, and he is hereby appointed liquidator for the purposes of such winding up.

That the liquidator be and is hereby authorised to consent to the registration of a new company under the name of the New Hermand Oil Company (Limited), or any other name that may be agreed upon, with a capital of one hundred thousand pounds, divided into thirty thousand preference share, of one pound each, and seventy thousand ordinary shares of one pound each.

That the liquidator be, and he is hereby authorised to sell or transfer the assets and undertaking of this company to such new company, when registered, upon the terms contained in the draft agreement expressed to be made between this company, its liquidator, and the new company, and that with such modifications (if any) as may be assented to by the liquidator with the approval of the directors of this company.

Mr David Cairns. Leith, seconded.

The resolutions, on being put to the meeting, were confirmed by a similar vote, 27 for 8 against. Mr Cairns thought it was about time they had a little better feeling in the company than they had in the past. They should put their shoulders to the wheel and go forward.

Councillor Hamilton. Leith, hoped the directors would get a competent man to deal with the works, because the salvation of the company depended upon that. On the motion of the Rev. P. M. Hertford, Leith, a vote of thanks was given to the chairman.

REPORT OF THE DIRECTORS

The directors, in their report for the year ending 31st March last, state that they regret the results are so disappointing. Briefly, they may be summed up as follows: -

(1) The enormous reduction in value of oil products last year, which on a normal throughput meant a sum approaching £10,000 to the Hermand Company.

(2) The strike that occurred in July, on the part of the miners, and which lasted for ten weeks, necessitating the closing down of the retorts.

(3) The impossibility of immediately reducing working costs to anything like the same extent as the fall in revenues.

The entire loss incurred during the strike, and which, of course, amounted to a very considerable sum, is included under the item “Loss in Manufacture, etc.” The directors, immediately after the suspension of the Linlithgow Oil Company in February last stopped all the old retorts, and at the same time came to a new arrangement with their miners in reference to the system of working the shale field, and they are very glad to be now in a position to state that the results which have since been obtained show a very decided improvement. They believe that this is due partly to the improved quality of the shale now being worked, and likewise to the fact that only the new retorts are in use.

The yields since February have been very steady and satisfactory, and the directors, along with the committee of shareholders which was appointed on 23rd April last, consider that they afford distinct encouragement to proceed with the erection of additional retorts. If this done there is a good prospect of a satisfactory profit being earned, even at the low prices presently ruling for oil. As for sulphate of ammonia, the present value is above the normal, and the directors base their calculations on a price considerably under the figure which is being realised at present.

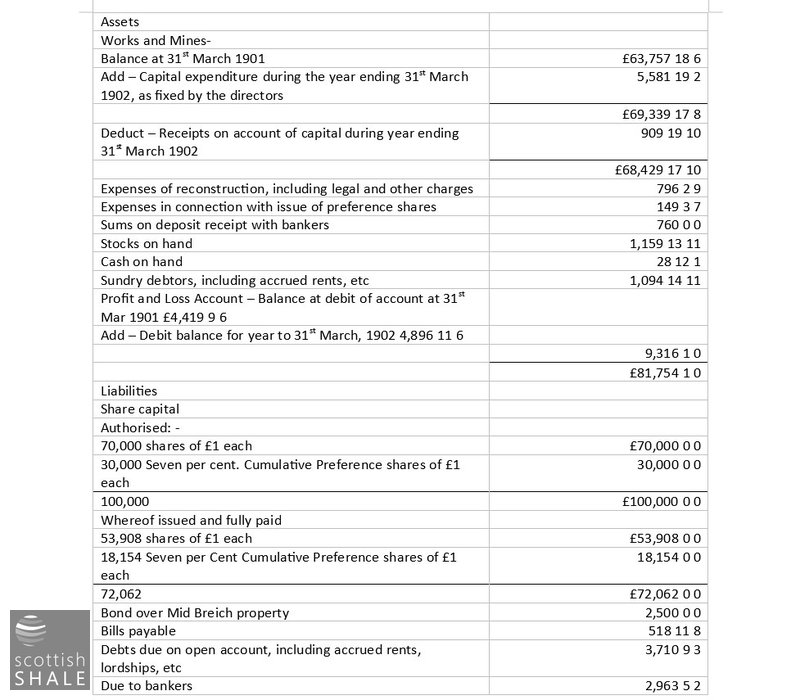

ABSTRACT BALANCE SHEET as at 31 March, 1902.

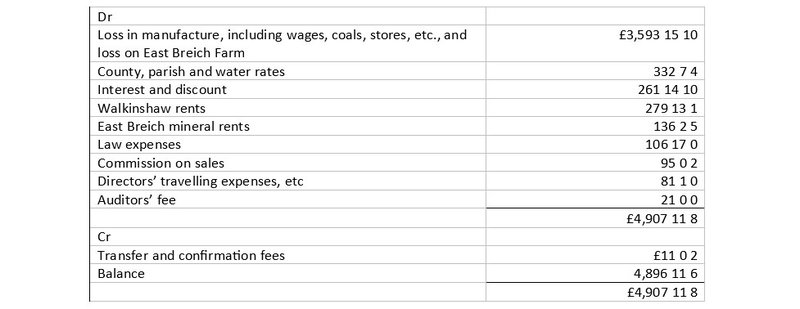

ABSTRACT PROFIT AND LOSS ACCOUNT for year ending 31st March, 1902

West Lothian Courier, 27th June 1902